Japan is known as a “cash society,” but having

a credit card in Japan can be very convenient.

A few months ago, I decided that I’d like a Japanese credit card of my own. I’ve been using my US CitiBank card, which is accepted at a lot of stores in Japan. My American CitiBank card is great in that regard, but charges an international usage fee that I could escape if I were to use a Japanese credit card.

For this reason, I applied for the Life Card. Much to my dismay,

I was rejected. Talking to a coworker about it afterwards, he asked why I went for such a “high class” card. The fact is, I’m not familiar enough with credit cards in Japan to know which credit cards are easy to get for someone like me, a younger person with a lower income who hasn’t lived in Japan for a long time.

I decided to do a little research to find which

credit cards are easy for foreigners in Japan to acquire.

Note About Japanese Credit Cards Types

Of course, there are types of credit cards that are easier to receive than others. A non-Japanese friend of mine was able to get a department store credit card the same day as the application was submitted.

I personally prefer to stick with bank credit cards, which may be a bit more difficult to get. This list is mostly of bank credit cards. This is my preference as a lay-person. So please keep in mind that

I am not a professional and that I

can’t take responsibility for the results of applying for or using any of these cards. Thank you for your understanding.

Notes About Additional Research

The table below is not by any means a thorough write-up of the credit cards. You can use it as a guideline. Once you’ve decided on a few cards that sound good, you should also

research other aspects of the cards as well. Some items I’d suggest looking up would be:

- Interest rates

- Reputation of card

- Possibility of adding family credit cards

- Additional rewards, programs, and reward details

- Possibility of usage overseas

- Details of paying the premium (when to pay, how much to pay, how to pay)

- Buyer’s insurance/theft/loss

12 Japanese Credit Cards for Foreigners to Consider

I’ve compiled this list of twelve credit cards which in theory may be easier for foreigners in Japan to receive. I’ve listed the credit card

name, the credit card

brand, the

yearly fee, and some of the

rewardsassociate with the card. All of this information comes from the cards’ official websites. This

information may change, so please just use this as a guideline and double check on the official website.

As a side note, students may have more trouble getting a credit card in Japan. According to the credit cards’ official websites and the above mentioned guides, the following cards are

recommended to students: MUFG Card Initial American Express Card, Walmart Card Saison American Express Card, Saison Card International, Aeon Card. In this case “student” usually means a student at a four-year university, not high school students / language school students / trade school students / etc.

Before I choose a card, I plan to do more research about the cards. I’ll post that research about Japanese credit cards later and also let you know how my application goes.

ike renting an apartment, obtaining a credit card in Japan is an exercise in patience and pain. To help ease some of that pain we have put together a simple overview to help you on the way. Do you have more personal experiences? Please feel free to add them in the comments.

The Basics

Securing a yen-based credit card not only makes your life in Japan easier, it is also essential if you want to access services such as online travel and booking, local ecommerce sites and plenty more besides. If you run your own business in Japan then it becomes absolutely vital.

Using a credit card from home is an option, however it will leave you with plenty of extra charges such as a foreign currency exchange fee and in some cases, additional merchant bills.

The Process

The first thing to keep in mind if you have chosen to apply for a Japanese credit card is that there are three unique methods of re-payment. The three types are:

1. One-time or full payment (ikkatsu barai). Usually no interest is charged.

2. Multiple payment plans (bunkatsu barai). Divides the total charge by the number of months you want to pay for it. Interest added.

3. Revolving credit (ripo barai). Pay a set minimum monthly payment, and your total balance of credit is charged interest.

Each of these apply to the one of five international credit card providers: JCB, Visa, MasterCard, Diner’s Club and American Express. For the relevant benefits of each, you should check how they are sold in your home country, though do note that JCB is only available in Japan.

Next, choose where you would like to get your card from – e.g. a bank, a retailer, or another service type, such as the post office, department stores, or online services. There are pros and cons for each; a lot of it will come down to your needs, convenience and how much you value additional features such as IC card integration or store points.

Foreigners generally find it difficult to get a credit card as they are thought to be a credit risk as short-term residents.

See here for one resident’s story on just how difficult it was when applying for a credit card with a nationwide bank. If you do go through something like this, consulting with credit counselors – usually found on the top floor of department stores – can often help.

Some cards in Japan charge an annual membership fee that can range from about 1,500 yen up to 10,000 yen per year but will provide cash-back programs, airline mileage points, and discounts. Some cards will offer specific combinations of these to specific customer groups, for example there are credit card services designed especially for woman.

Credit Card Table

Credit card name |

Brands |

Yearly fee |

Rewards |

Mitsui Card

|

Visa, JCB |

500 yen/year (first year free; free for the following year if you buy 50000 yen or more a year) |

Point System (exchange points for shopping, ANA miles, etc.) |

Family Card International

|

Mastercard, Visa, JCB |

None (forever) |

Point System (never expire, exchange points for JAL miles, or docomo or au points, etc.) |

Seven Card

|

Visa |

500 yen/year (first year free; free for the following year if you buy 50000 yen or more a year) |

Point System (exchange points for shopping, ANA miles, etc.) |

ENEOS

|

American Express |

None (forever) |

Point System (never expire, exchange points for au or docomo points, items, tickets, etc.) |

MUFG Card Gold American Express Card

|

American Express |

2000 yen/year (first year free) |

Point Program (exchange points for JAL or United miles, au/softbank/docomo points, online shopping, etc.) |

MUFG Card Initial American Express Card (only for those 29 years old and younger) |

American Express |

1312 yen/year (first year free, free while you are a student) |

Point Program (exchange points for JAL or United miles, au/softbank/docomo points, online shopping, etc.) |

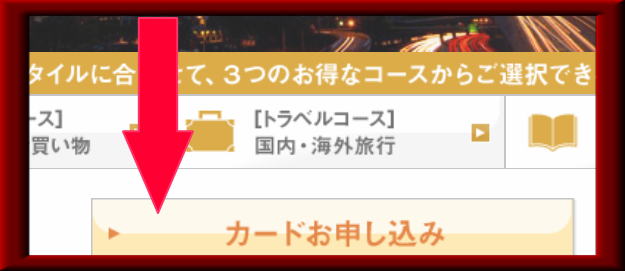

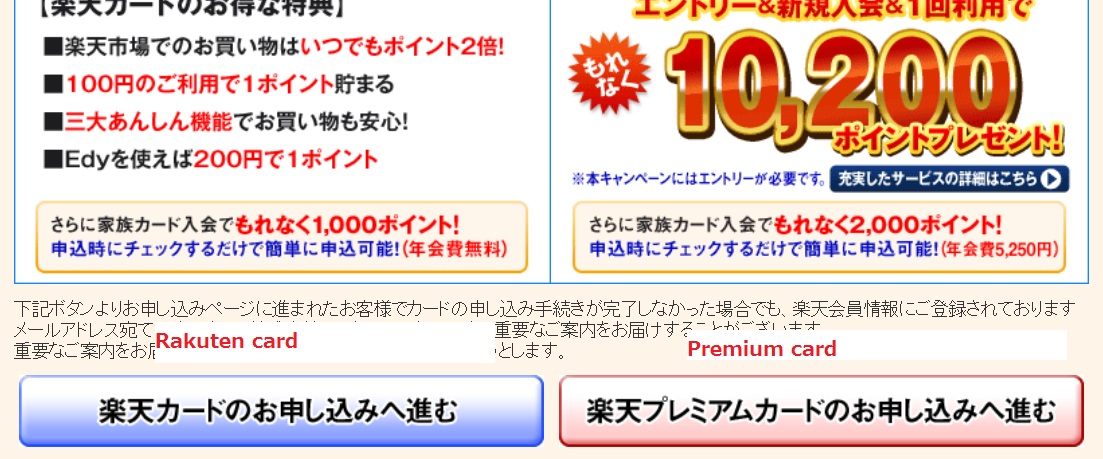

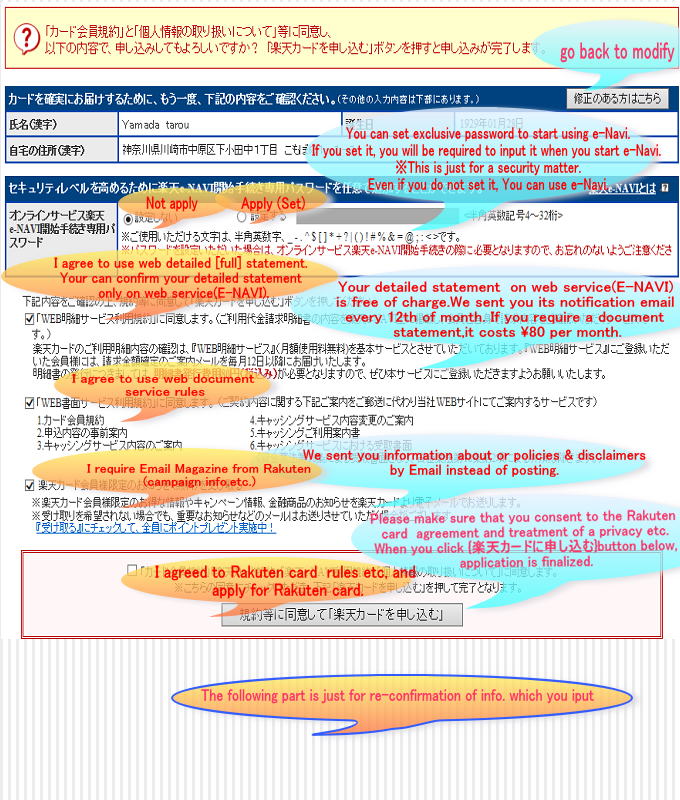

Rakuten Card |

JCB, Visa, Mastercard |

2000 yen/year (first year free) |

Point Program (exchange points for JAL or United miles, au/softbank/docomo points, online shopping, etc.) |

Mitsui Sumitomo EVA Plus Card(only available to those between 18 and 25) |

VISA |

1312 yen/year (First year free; free after that if you use at least once a year) |

|

Viaso Card |

Visa |

None (forever) |

Cash Back (automatically receive 1 yen for 1 point) |

JAL Card |

Visa, Mastercard |

- Annual membership fee (tax included) :

- Regular Card : ¥2,160 (¥6,480 on JAL American Express® card)

- CLUB-A Card : ¥10,800

- CLUB-A Gold Card : ¥17,280 (¥20,520 on JAL American Express® card)

- JAL Diners Card : ¥30,240

- Platinum : ¥33,480

|

- Eligibility

- For Regular and CLUB-A memberships, individuals must be 18 years of age or older (except high school students). <The other cards have different eligibility. Please inquire.>

Must have bank account in Japan.

For "JALCARD Suica" membership, individuals must be residents of Japan.

- Purchases charged to your JALCARD will accrue mileage automatically in your JMB account. Use of "JALCARD Suica" on purchases of JR tickets can accumulate VIEW Thanks points.

- Complete the application and send it directly to JALCARD, Inc.

- JALCARD requires credit screening. (JALCARDs are mailed to your registered address in about 4 weeks, after completion of the credit card screening process.)

|

Aeon Card |

Visa, Mastercard, JCB |

None (forever) |

Point system (WAON points; can use points at Aeon stores, McDonald’s, Family Mart, etc.) |

ANA Visa Suica Card |

Visa |

2100 yen/year (first year free) |

ANA Miles |

Do you have a Japanese credit card? What is your advice for getting one and what is the best credit card for foreigners in Japan?

As is the case with many people, coming to Japan was a real change of pace for me. After finishing uni and deciding that the land of the long, white tobacco cloud was not for me, I said goodbye stable home life and hello freedom. For the first time, I was living alone, paying things called “rent” and “bills,” and enjoying the next step in my young, innocent life.

I’ve always been a cash man, so there was no adjustment necessary when I moved to Japan.

If I wanted something, I paid cash. If I didn’t have money, I waited until I did. If I was in urgent need of a loan, then it was on the phone to the folks Down Under to beg for a U.S.-style financial bailout.

The problem with this good economic sense is that the world expects you to be packing plastic. Whether hiring a Lexus, booking a room at the Peninsula, or subscribing to dubious Internet sites, it’s almost a requirement that you have a credit card.

The final straw came when I was holidaying overseas and went to check in to my hotel.

“Sir, can I please see your credit card?” asked the receptionist.

“Um, I don’t have one….”

“Huh? What do you mean?”

I don’t know what was more embarrassing — her response, or me having to leave, tail between my legs.

So despite having lived an almost trouble-free 24 years sans card, I decided it was time to take on the responsibility. Almost like a rite of passage.

In Japan, applying for a credit card is easy. A trip to my local Super Autobacs had me crossing paths with the in-store credit card man who, to my delight, spoke English. This and the gift of 1,000 Autobacs yen sealed the deal: my application was away. Three to five weeks later, I was awoken by a call from Visa. Exactly what was said, I don’t know, but after 10 painful minutes it was clear that I was being rejected.

A few months passed until I got around to applying again, this time at my local UFJ bank. Having been a loyal customer for well over a year, I thought I was a shoe-in. Again, helpful staff, again waiting period, and again rejection. The 500 yen shopping voucher the bank gave me was of little consolation.

The quest continued. First Mizuho told me to get lost. OK, that’s not quite true — they “suggested” I try the local SMBC. Which was unmanned. So I went back to Mizuho and, ultimately, got rejected, but picked up a bank account I didn’t need. Next, Citibank was happy to speak to me. This went well until I realized their fees would probably drag me below the poverty line. So it was back to UFJ, which this time around gave me a cheap clock and once again filed my application under “fat chance, gaijin.”

Now, all of this seems a bit suspect. I can’t remember the last time I entered a shopping center without passing the credit card table. Banks are always advertising them. You’d think it’s a shoppers’ market. On top of that, I am seemingly part of an in-demand demographic: I’m young, have a steady job, have lived years at the same address, and have no bad credit history because I have had… no credit. Right around now, most of you are probably thinking that the deciding factor in these repeated rejections is my fair hair and pasty-white complexion. I hope that’s not true, but I’m running out of ideas.

So what other options do I have? If it’s fast cash I’m after, I could try a credit financing firm like Aiful or Acom. But I avoid these loan sharks because of their high interest and potential for fast-mounting debt. Another idea is to organize a credit card from Australia. Assuming I’m accepted, though, I then have to worry about fluctuating exchange rates and whether the card would be accepted in Japanese stores.

If I’m really eager for a Japanese card, there’s one other thing I can do: call the local credit companies, who will advise me to visit one of their counselors, often found in big department stores. This representative would no doubt explain that having a Japanese spouse, job stability, solid local residency and a guarantor would do wonders for my application.

But what if you’re unmarried, between jobs, new to Japan and don’t like others to be accountable for your actions? Or what if you’re simply a lowly foreigner who just wants the chance to reply “credit” once in a while? Do like I do: tap your ruby slippers three times, apply for everything and, at worst, snap up all the free gift vouchers, clocks, laundry powder, happoshu, bags, calendars and aprons you can.

Edy

Edy Edy

Edy

神戶米其林旅館及HOTEL指南

神戶米其林旅館及HOTEL指南

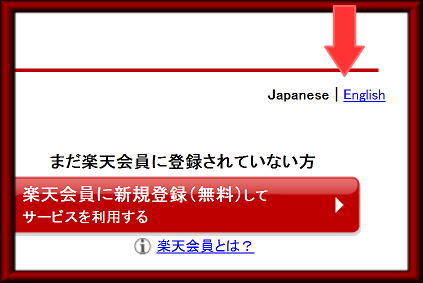

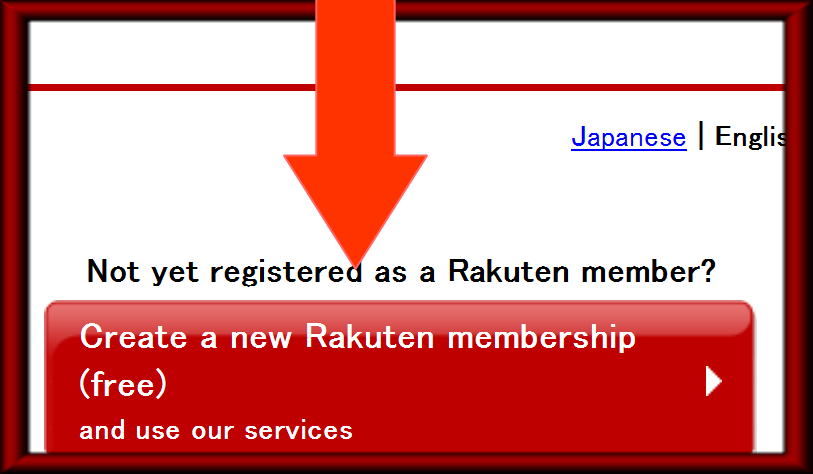

Rakuten Card

Standard Rakuten Credit Card with Edy function.

Customer Satisfaction No.1 credit Card in Japan.